Market Analysis

-

October 11, 2025

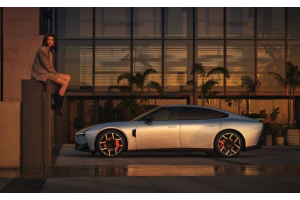

IM Motors Enters Singapore Market: A Strategic Move for Global Expansion

IM Motors, a premium Chinese electric vehicle (EV) brand supported by SAIC Motor, Alibaba, and Zhangjiang Hi-Tech, officially launched in Singapore on October 9, 2025, with the opening of its flagship showroom at 11 Leng Kee Road. This event marks a significant milestone for both IM Motors and the Singaporean automotive industry, as the brand targets the right-hand-drive, luxury, and new energy vehicle (NEV) segments in Southeast Asia. For global clients, particularly those in the Middle East, Americas, and Africa who are new to importing cars from China, this move highlights the growing appeal and reliability of Chinese EVs.

Key Models Launched in Singapore

IM Motors is introducing two models in Singapore: the IM5 (overseas version of the IM L6) and the IM6 (overseas version of the IM LS6). Both vehicles are classified under Singapore's Categories A and B COE (Certificate of Entitlement), making them accessible to

-

October 10, 2025

XPeng Motors Sales Report: 313,000 Units Sold in First Three Quarters of 2025, Annual Target 89.5% Achieved

XPeng Motors has demonstrated remarkable performance in the first three quarters of 2025, with cumulative sales reaching 313,000 vehicles, a staggering year-on-year increase of 217.8%. The company has achieved 89.5% of its annual sales target, ranking first among emerging automotive brands. With only approximately 37,000 vehicles remaining to meet the full-year goal of 350,000 units, XPeng is poised to complete its annual target ahead of schedule.

Key Background and Sales Performance

In September 2025 alone, XPeng sold 41,581 vehicles, indicating that the company could potentially achieve its annual target within just one month. This performance significantly outpaces other emerging competitors in the market.

When compared to other prominent electric vehicle brands, XPeng's target completion rate stands substantially higher. Competitors such as Leapmotor, Li Auto, and Xiaomi have

-

September 30, 2025

All-New Volvo XC70 Launched in China: A Premium PHEV SUV Set for Global Export

The all-new Volvo XC70 made its debut in the Chinese market on September 26, 2025. This luxury plug-in hybrid electric SUV combines advanced hybrid architecture, a premium interior with cutting-edge technology, and competitive pricing, targeting the rapidly expanding PHEV segment in China. With promotional pricing starting at 269,900 yuan (approximately US$37,100), and regular variants typically priced between 299,900 yuan and 349,900 yuan (US$41,300–US$48,200) depending on trim, the XC70 is positioned to attract global buyers, especially those in the Middle East, Americas, and Africa, looking for reliable, high-performance vehicles from China.

Key Specifications and Technological Highlights

Hybrid Powertrain: The XC70 integrates a 1.5-liter turbocharged engine with three electric motors (P1+P2+P4) and a 3DHT hybrid transmission, generating a combined output of up to 340 kW. The all-wheel drive extended-range

-

September 26, 2025

Dongfeng Nissan's New Teana "Teana PLUS" to Feature HarmonySpace 5 and HUAWEI SOUND, Launching Q4 2025

By TopUsedCars.com reporter Xiao Mi

Dongfeng Nissan has unveiled significant upgrades for its flagship sedan, the Teana, with the new "Teana PLUS" variant. The model is set to launch in the fourth quarter of 2025 and will be equipped with the Huawei HarmonySpace 5 intelligent cockpit system and a HUAWEI SOUND audio system. While retaining the proven 2.0L and 2.0T powertrain options, the Teana PLUS receives a comprehensive overhaul in its exterior design and intelligent features. The pre-sale price is expected to remain in the range of 179,800 CNY to 239,800 CNY.

Key Upgrades and Configurations

Intelligent Cockpit: A Leap Forward

The most notable upgrade is the integration of the HarmonySpace 5 cockpit system. This system enables seamless multi-screen media streaming, voice and light interaction, and features the smart assistant Xiao Yi. The audio experience is enhanced by the HUAWEI

-

September 23, 2025

Chinese PHEV B-Sedan Prices Plummet, Offering Unprecedented Value

The Chinese automotive market is witnessing a seismic shift as plug-in hybrid electric (PHEV) B-segment sedans see dramatic price reductions. Models like the Roewe M7 DMH, the Geely Galaxy A7, and the BYD Seal 06 DM-i are now available with starting prices firmly in the 80,000 to 100,000 yuan range. This positions them significantly below the traditional price point of popular compact gasoline sedans like the Honda Civic or Toyota Corolla, which typically start above 100,000 yuan, showcasing the aggressive pricing power of domestic Chinese brands.

Price Information & Reference Exchange Rate

- Roewe M7 DMH: 85,800 - 102,800 yuan (Approx. US$12,060 – US$14,449 at CNY:USD ≈ 7.1)

- Geely Galaxy A7: 81,800 - 117,800 yuan (Approx. US$11,497 – US$16,557)

- BYD Seal 06 DM-i: 99,800 - 139,800 yuan (Approx. US$14,027 – US$19,650)

Core Model Specifications Comparison

Model Price Range (10k yuan) Dimensions (LxWxH, mm) Wheelbase (mm) Engine -

September 18, 2025

BYD Tang DM-i 175KM Long-Range Edition Launched: A New Benchmark in Intelligent, Efficient Family SUVs

TopUsedCars.com reporter Xiao Mi — On September 16, 2025, BYD officially launched the all-new Tang DM-i 175KM Intelligent Driving Edition, a mid-size seven-seater plug-in hybrid SUV designed for global families seeking superior range, intelligence, and comfort. Priced between CNY 179,800 and 199,800 (approx. $24,620–$27,370), the model also offers an exclusive CNY 10,000 exchange subsidy for purchases made before October 31, 2025.

Range and Efficiency

The new Tang DM-i introduces BYD’s latest Power Blade Battery with an energy density of 114.9 Wh/kg, enabling a pure electric range of 175 km under CLTC conditions. This significantly reduces charging frequency for daily commutes. With DC fast charging support up to 53 kW, the battery can be replenished from 30% to 80% in just 20 minutes. The battery pack is rated IPX8 for water and dust resistance and has passed nail penetration tests,

-

September 17, 2025

Buick ELETRA L7: SAIC-GM's Premium Electric Sedan Enters China's NEV Market

The Buick ELETRA L7 is the latest flagship model under SAIC-GM's new energy vehicle sub-brand ELETRA. Positioned as a luxury range-extended electric vehicle (EREV), it targets mid to high-end consumers in China. The vehicle made its official debut in September 2025 and is now available at dealerships across the country. An Early Bird program offers lifetime free maintenance for orders placed before September 28.

Key Specifications and Technical Highlights

Built on the innovative "Xiao Yao" integrated vehicle platform, the ELETRA L7 is engineered specifically for new energy applications. It boasts a pure electric range of 302 km under the CLTC cycle and a combined range of 1,420 km when utilizing both battery and range-extender. Fuel consumption is remarkably low at 0.5 L/100km. The model is equipped with a 40.2 kWh Ultium 2.0 lithium iron phosphate (LFP) battery.

Charging capabilities include 130 kW DC fast charging

-

September 11, 2025

BYD FANGCHENGBAO Launches Tai 7: A New Benchmark in Mid-to-Large PHEV SUVs

TopUsedCars.com reporter Xiao Mi - September 9, 2025

BYD's premium off-road sub-brand, FANGCHENGBAO, has officially launched the Tai 7, a mid-to-large plug-in hybrid SUV designed for both urban and adventure use. The model is available in four trims, with prices starting from 179,800 yuan (approx. $25,200) and going up to 219,800 yuan (approx. $30,800). Deliveries began on the same day as the launch.

Powertrain and Performance

The Tai 7 is equipped with BYD’s latest DM next-generation plug-in hybrid system, which includes a 1.5T turbo engine. The rear-wheel-drive (RWD) variant features a single 200 kW front motor, accelerating from 0 to 100 km/h in 7.5 to 7.9 seconds. The all-wheel-drive (AWD) version utilizes a 160 kW front motor and a 200 kW rear motor, achieving an impressive 0–100 km/h in just 4.5 seconds.

The SUV offers two battery options: a 26.6 kWh battery for the RWD model, providing an electric range

-

September 09, 2025

Changan Accelerates Global Strategy with DEEPAL S05 European Launch at IAA 2025

Changan Automobile made significant strides in its global expansion strategy at IAA Mobility 2025 in Munich by unveiling the all-electric DEEPAL S05, delivering the first unit to a European customer, and outlining ambitious growth targets for Europe and international markets. The brand coordinated simultaneous launch events in Chongqing and Munich, demonstrating a synchronized approach to domestic and international market development.

Key Highlights & Latest Developments

DEEPAL S05 Launch and European Market Entry

The DEEPAL S05, an electric compact crossover, was officially unveiled and handed over to its first European customer during the Munich auto show. The vehicle debuted at concurrent global events in Chongqing, highlighting Changan's accelerated push into the European new energy vehicle market. The company plans to expand across more than ten European regions by the end of 2025.

Product & Technical