Worldwide Import Regulation

-

September 10, 2025

CATL Redefines EV Battery Standards with NP3.0 Safety Platform and Shenxing Pro LFP Battery at Munich Event

On September 7, 2025, CATL, China’s leading battery manufacturer, introduced two groundbreaking technologies at its Munich event: the NP3.0 (No Propagation 3.0) battery safety technology platform and the Shenxing Pro LFP battery. These innovations set a new benchmark for electric vehicle battery safety, fast charging, range, and lifecycle performance, specifically targeting the European and global markets.

Key Innovations in NP3.0 Safety Technology

The NP3.0 platform incorporates eight core safety features, including flame-retardant electrolyte, flame-retardant separator, nano-coating on the cathode, cell safety devices, aerogel insulation pads, fire-retardant coating, circuit stabilization, and high-voltage active cooling. This comprehensive approach ensures superior protection against thermal runaway, a critical concern for EV safety.

In extreme scenarios, NP3.0 prevents heat

-

September 05, 2025

2025 Toyota RAV4 Facelift Spotted in Camouflage: Key Upgrades in Design, Powertrain, and Interior

The upcoming 2025 Toyota RAV4 has been spotted during road tests, showcasing significant updates to its exterior, powertrain, and interior configuration. With a bolder front fascia and dark alloy wheels, the new model targets the youth market while maintaining off-road capabilities.

Design and Exterior Updates

The new RAV4 retains the current model’s squared-off wheel arches and overall proportions. Elements such as the A-pillar, side mirrors, and door handles remain largely unchanged.

The front end receives a major overhaul, adopting a hammerhead-style LED headlamp design and a borderless grille, giving it a more rugged appearance similar to Toyota’s bZ4X and the latest Camry.

Dark-toned or larger-sized wheels along with enhanced cladding emphasize its off-road character, reminiscent of the Woodland Edition. Some reports suggest a slight reduction in overall length for improved handling, though

-

September 04, 2025

August 2025 China's New Energy Vehicle Sales Ranking: Leapmotor Leads with Record Deliveries

In August 2025, Chinese new energy vehicle manufacturers demonstrated robust growth, with Leapmotor securing the top position with 57,066 units delivered, marking an 88% year-over-year increase. Huawei's Harmony Intelligence Auto followed closely with 44,579 units, while XPeng and NIO ranked third and fourth, respectively. Xiaomi Auto maintained strong momentum with over 30,000 deliveries for the second consecutive month, reflecting the sector's overall expansion.

Key Delivery Highlights for Major NEV Brands in August

Leapmotor achieved 57,066 deliveries, an 88% increase from the previous year, reaffirming its leadership. Cumulative deliveries have surpassed 900,000 units. The new Lafa5 (B05) model is set to debut at the Munich Motor Show on September 8.

Harmony Intelligence Auto delivered 44,579 units, nearly 90% of which came from the AITO series (AITO 40,012 units, M9 10,067 units, M8 21,537

-

September 03, 2025

Geely Galaxy Xingyao 6: New Entry-Level PHEV Sedan Set for Global Launch

Geely has officially unveiled the Galaxy Xingyao 6, a new plug-in hybrid electric sedan positioned as an entry-level model below the Galaxy A7. The vehicle is equipped with Geely's latest hybrid technology and is poised to enter international markets soon, pending final regulatory approvals.

Key Specifications and Features

The Xingyao 6 measures 4,806mm in length, 1,886mm in width, and 1,490mm in height, with a wheelbase of 2,756mm. It is powered by a 1.5-liter engine producing 82kW, paired with a 17kWh battery pack supplied by CALB. The model is expected to utilize Geely's NordThor EM-i PHEV platform, ensuring efficiency and performance. Its top speed is rated at 180km/h.

Design-wise, the Xingyao 6 features a new geometric styling language, including a large shield-shaped grille with vertical slats, sharp headlights, a triple-section lower intake, and muscular hood creases, giving it a modern and aggressive

-

August 20, 2025

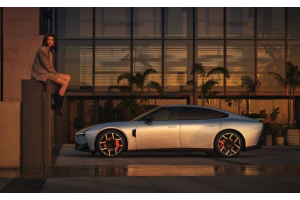

All-New XPENG P7 Wing Edition: The Ultimate Electric Sport Sedan with Scissor Doors

Key Highlights

• Scissor doors & matte silver paint for head-turning exclusivity

• Dual-motor AWD delivers 586 hp (437 kW) and 0-100 km/h in 3.7 seconds

• Industry-leading 800V SiC platform charges 525 km in 10 minutes

• Over 10,000 pre-orders secured within 6 minutes of launchExclusive Design

The P7 Wing Edition stands out with its aerodynamic scissor doors and premium finishes including:

- Matte silver exterior paint (exclusive to this model)

- Seamless light-bar DRLs with matrix LED headlights

- 21-inch forged gunmetal wheels

- Flush-illuminated XPENG logo

Performance & Range

Variant Power Battery Range (CLTC) Acceleration Single Motor RWD 270 kW 74.9 kWh 702 km Not specified Dual Motor AWD 437 kW (586 hp) 92.2 kWh 820 km / 750 km 3.7–4.1 sec Cutting-Edge Technology

• 87-inch panoramic AR-HUD

• Tri-axis floating central display

• 9-inch digital rearview mirror

• Xmart OS 4.0 with OTA updates

• Touch Pad smart -

August 08, 2025

China's Top-Selling Electric Vehicles in First Half of 2025: Compact Models Dominate

Market Leaders: Geely Xingyuan, BYD Seagull, and Wuling Hongguang MINIEV

The best-selling new energy vehicles in China during the first half of 2025 were:

- Geely Xingyuan (205,000 units)

- BYD Seagull (175,000 units)

- Wuling Hongguang MINIEV (171,000 units)

These compact electric vehicles have gained tremendous popularity due to their distinctive designs, easy maneuverability, low energy consumption, sufficient range for daily commutes, and affordable pricing.

Why Compact EVs Are Winning the Market

- Competitive Pricing: All models are positioned in highly affordable price segments, meeting the economic needs of average families.

- Urban Practicality: Compact dimensions make them ideal for city driving and parking, with lower operating costs than conventional vehicles.

- Adequate Range: Battery capacity perfectly covers most urban and suburban commuting needs.

- Smart Features: Some models incorporate basic intelligent

-

August 07, 2025

Leapmotor B01: A Game-Changer in the 100,000 RMB EV Sedan Market

Overview

The Leapmotor B01 has emerged as a formidable contender in the competitive 100,000 RMB new energy sedan segment, thanks to its exceptional configuration, competitive pricing, and impressive delivery efficiency. The model achieved 10,132 locked orders within 72 hours of launch, with the first 10,000 units rolling off the production line in just 7 days. Notably, Leapmotor ensured immediate delivery upon launch, effectively eliminating the "futures trap" and showcasing its strong production capacity and supply chain advantages.

Pricing (Converted to USD)

The official price range for the Leapmotor B01 is 89,800-119,800 RMB (approximately $12,386-$16,538 USD at an exchange rate of 7.25 CNY/USD).

Powertrain and Range

The B01 offers two electric drive systems with peak power outputs of 132kW and 160kW, and peak torque of 175N·m and 240N·m respectively. It comes with three battery capacity options: 43.9kWh, 56.2kWh, and

-

August 05, 2025

Budget-Friendly Chinese Hybrid SUV Showdown: Changan UNI-Z vs Geely Galaxy L7

Introduction

For global buyers seeking quality hybrid SUVs under $15,000, two Chinese models stand out: the Changan UNI-Z Warship Edition and Geely Galaxy L7 EM-i Explorer+. These autonomous brand hybrids offer compelling value but differ significantly in pricing, space, electrification, and smart features.

1. Pricing & Purchase Benefits

- Changan UNI-Z Warship Edition: MSRP $17,347 (¥124,900) with current $2,083 (¥15,000) cash discount, final price $15,264 (¥109,900). With trade-in, can drop to $11,792 (¥84,900).

- Geely Galaxy L7 EM-i Explorer+: Priced at $17,056 (¥122,800) with only optional package credits available.

Key Point: UNI-Z offers approximately $1,806 (¥13,000) better value after discounts.

2. Powertrain & Efficiency

Changan UNI-Z features Blue Whale plug-in/range-extender dual-mode system (158kW/330Nm, 0-100km/h in 7.4s) with 125km CLTC pure-electric range.

Geely Galaxy L7 boasts superior fuel

-

July 18, 2025

Volkswagen Sagitar L: The Upgraded Compact Sedan Redefining China's Auto Exports

Introduction

The all-new Volkswagen Sagitar L has emerged as a game-changer in China's compact A+ sedan market, combining German engineering with cutting-edge Chinese automotive technology. As Volkswagen's strategic model positioned between the Bora and Magotan, this comprehensively upgraded version delivers exceptional value for international buyers seeking premium quality at competitive prices.

Key Upgrades & Competitive Advantages

Exterior & Intelligent Technology

- Full-width LED light bar integrated with black trim enhances visual width and technological appeal

- Standard millimeter-wave radar and high-resolution cameras enable L2 autonomous driving capabilities

- Dimensions grow to 4812/1813/1472mm (vs 4791/1801/1465mm in 2025 model), maintaining 2731mm wheelbase

- Hidden door handles with winter de-icing function and multiple unlocking modes

- Full-width taillights with illuminated VW logo boost nighttime visibility

-

April 29, 2025

Step-by-Step Guide to Importing Cars from China to Mexico for Global Buyers

Essential Requirements for Vehicle Importation

The vehicle must be less than 8 years old to qualify for standard import procedures. Older vehicles face stricter requirements and higher duties.

All cars must comply with Mexican emissions standards (NOM-040-SEMARNAT-2012 for passenger cars) and have a clean title with no outstanding liens.

Luxury, sports, or armored vehicles generally cannot be imported under special programs and require special permits.

Required Documentation

- Original vehicle title and bill of sale

- Commercial invoice and packing list from Chinese seller

- Certificate of origin (for new vehicles)

- Combined Certificate of Value and Origin

- Bill of lading/sea waybill/air waybill

- Mexican Tax Identification Number (RFC)

- Registration as automobile importer with SAT

- Vehicle customs value declaration

- Authorization letter for customs broker

- Proof of economic solvency in Mexico

Import Process Step-by-Step

1. Register