China Auto Q1 2025: BYD Leads Profit Surge

Performance Review of China's A-Listed Automakers in Q1 2025

Strong Overall Performance with Notable Divergence

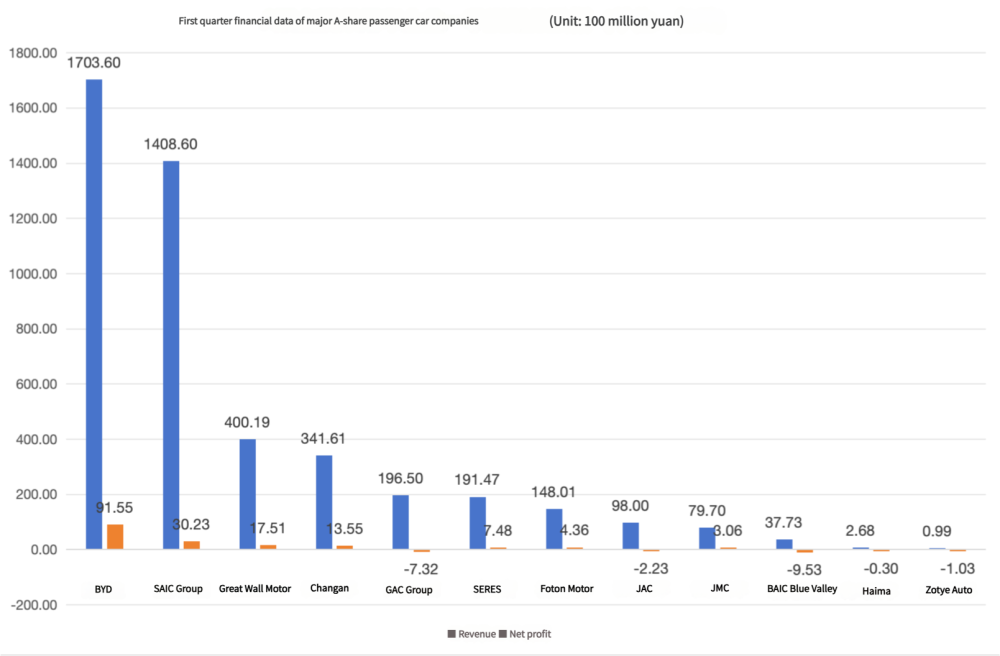

The first quarter of 2025 witnessed robust performance from China's A-listed automakers. Among 17 surveyed companies, 11 achieved year-on-year profit growth or reduced losses (64.71%), with BYD and SAIC Motor leading the pack at 9.155 billion yuan and 3.023 billion yuan net profit respectively.

Passenger Vehicle Segment Highlights

| Company | Net Profit (Billion Yuan) | YoY Growth |

|---|---|---|

| BYD | 91.55 | +100.38% |

| SAIC Motor | 30.23 | +11.40% |

| Seres | 0.748 | +240.60% |

| BAIC BluePark | -0.953 | Revenue/Sales Growth |

BYD dominated with 9.155 billion yuan net profit (+100.38% YoY), selling 1.0008 million vehicles globally (+60% YoY), including 200,000 overseas sales (+110% YoY). The company targets 5.5 million annual sales with 800,000 from international markets.

Seres achieved remarkable 240.6% profit growth despite revenue decline, while BAIC BluePark, Haima and Zotye showed significant loss reduction.

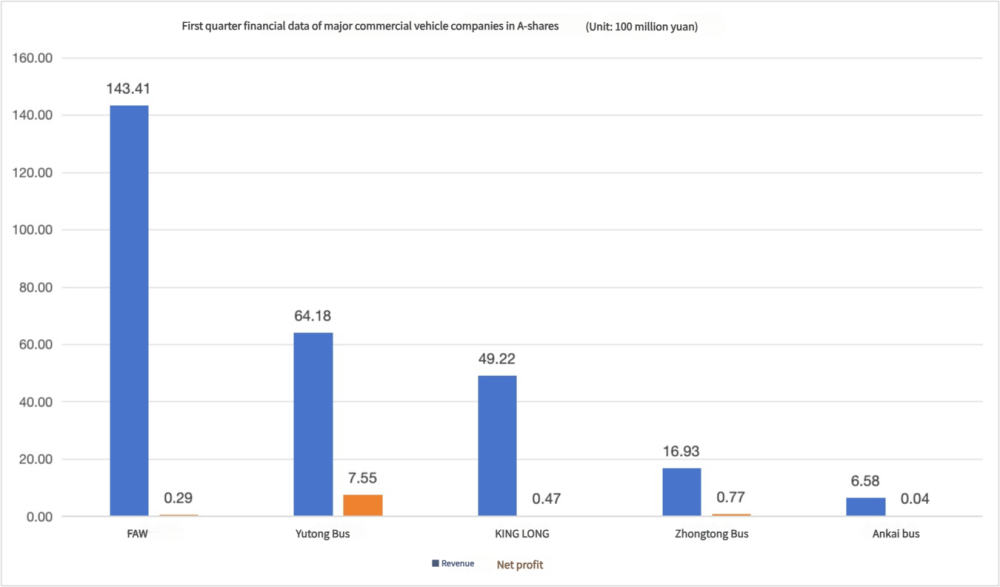

Commercial Vehicle Segment Outperformance

| Company | Net Profit (Billion Yuan) | YoY Growth |

|---|---|---|

| Yutong Bus | 0.755 | +14.91% |

| Zhongtong Bus | 0.077 | +80.52% |

| King Long | 0.047 | +164.79% |

Yutong Bus led with 755 million yuan profit, outperforming some passenger car makers. The sector showed exceptional growth, particularly King Long (+164.79%) and Zhongtong Bus (+80.52%).

Underperformers and Market Challenges

Six companies reported profit declines, with JAC Motors (-311.39%) and GAC Group (-159.95%) turning from profit to loss. JAC attributed this to decreased sales and reduced joint venture income, despite launching the premium "Zunjie" brand with Huawei (priced at 1-1.5 million yuan).

Great Wall Motors maintained profitability at 1.751 billion yuan but faced 45.6% profit decline, reflecting traditional automakers' challenges.

Market Trends and Outlook

China's passenger vehicle market grew 6% YoY in Q1 2025, exceeding expectations. The price war significantly eased with only 23 models cutting prices in March 2025 versus 51 in 2024, creating healthier market conditions.

Conclusion

China's auto industry shows accelerating divergence in Q1 2025. Leaders like BYD demonstrate how innovation and globalization drive growth, while traditional players face transformation pressures. The stabilized pricing environment and export growth (BYD's 110% overseas sales increase) present new opportunities for international buyers through platforms like TopUsedCars.com.