Brazil Auto Market Growth 2025

Brazil New Car Market Overview: April-May 2025

Market Recovery Gains Momentum

Brazil's automotive market showed strong signs of recovery in April 2025, with total new vehicle sales reaching 213,196 units, marking a 16.4% year-on-year increase and 8.6% growth from March. The positive trend continued in May with combined sales of cars and light commercial vehicles hitting 214,383 units. Cumulative sales for the first five months of 2025 stood at 927,291 vehicles, up 6% compared to the same period last year, though still below pre-pandemic levels - the January-May 2019 period recorded 1,035,481 units sold.

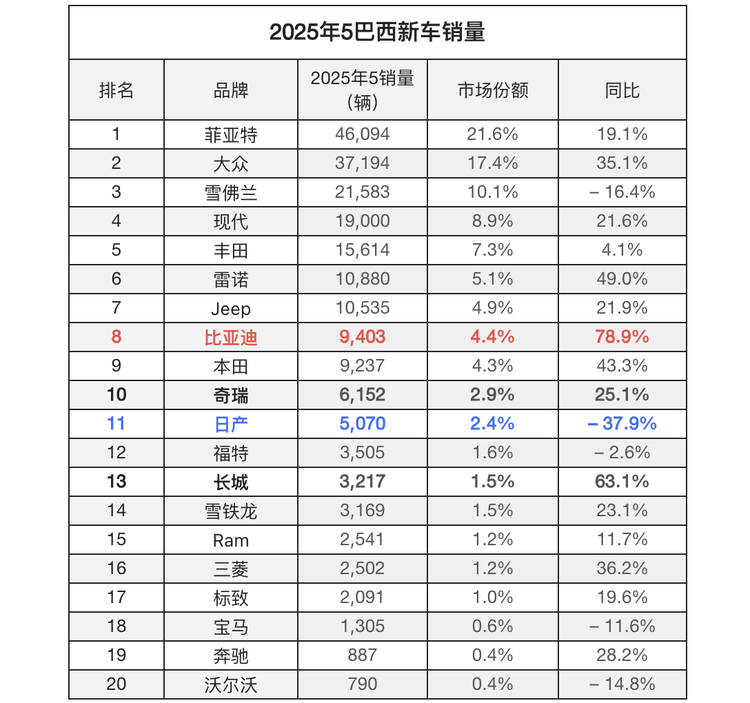

Market Structure and Brand Performance

The Brazilian market remains highly concentrated, with the top three brands (Fiat, Volkswagen, and Chevrolet) collectively holding 49.1% market share, maintaining European and American dominance.

Top Performers:

- Fiat: Sold over 46,000 units in April (+19.1% YoY), claiming 21.6% market share

- Volkswagen: Surged 35.1% YoY with 37,000+ units sold (17.4% share)

- Chevrolet: Struggled with 16.4% decline (21,583 units, just over 10% share)

Asian Brands Making Strides:

- Hyundai (4th position) grew 21.6%

- Toyota (5th) managed only 4.1% growth

- Renault impressed with 49% surge

Chinese Brands Breaking Records:

- BYD: Ranked 8th overall with 9,403 units sold in May (+78.9% YoY), capturing 8.67% market share

- Chery: Entered top 10 at 10th position (6,152 units, +25.1%)

- GWM: Jumped to 13th rank (3,217 units, +63.1%)

Top Selling Models

- Volkswagen Polo: Monthly champion with nearly 13,000 units (+52.2%)

- Fiat Strada (pickup): Second place with 12,000 units

- Volkswagen T-Cross: Rose to 3rd (9,410 units, +44.7%)

- Fiat Argo: 9,063 units (+65.2%)

- Honda HR-V: 75% growth (6,406 units) - fastest growing in top 10

- Chevrolet Onix: Only decliner in top 10 (-22.1%)

Chinese Models Gaining Traction:

- Chery Tiggo 7: 3,211 units (+89.6%, ranked 26th)

- BYD Song Plus: 2,900 units (27th)

- BYD Seagull: 2,577 units (31st)

- BYD Dolphin: 1,864 units (38th)

- GWM Haval H6: 2,432 units (+69.1%, 32nd)

EV and New Energy Trends

The new energy vehicle segment is expanding rapidly in Brazil, with Chinese brands commanding an impressive 80% share of the pure electric market.

Market Outlook

The Brazilian auto market continues its recovery trajectory in 2025, gradually approaching pre-pandemic levels. While traditional European and American brands still dominate, Chinese automakers like BYD and Chery are achieving historic breakthroughs with steadily increasing market shares. BYD's entry into the overall top 10 rankings and its leadership in the EV segment highlights the shifting market dynamics. The emergence of new energy vehicles and strong performances by Chinese brands point toward a more diversified and electrified future for Brazil's automotive industry.