US 25% Tariff on Imported Cars: Limited Impact on Chinese Automakers, Heavy Blow to Japanese, Korean, and German Brands

U.S. 25% Auto Tariff Impact: Key Insights for Global Car Buyers and Dealers

How the New U.S. Tariffs Affect Chinese Automakers

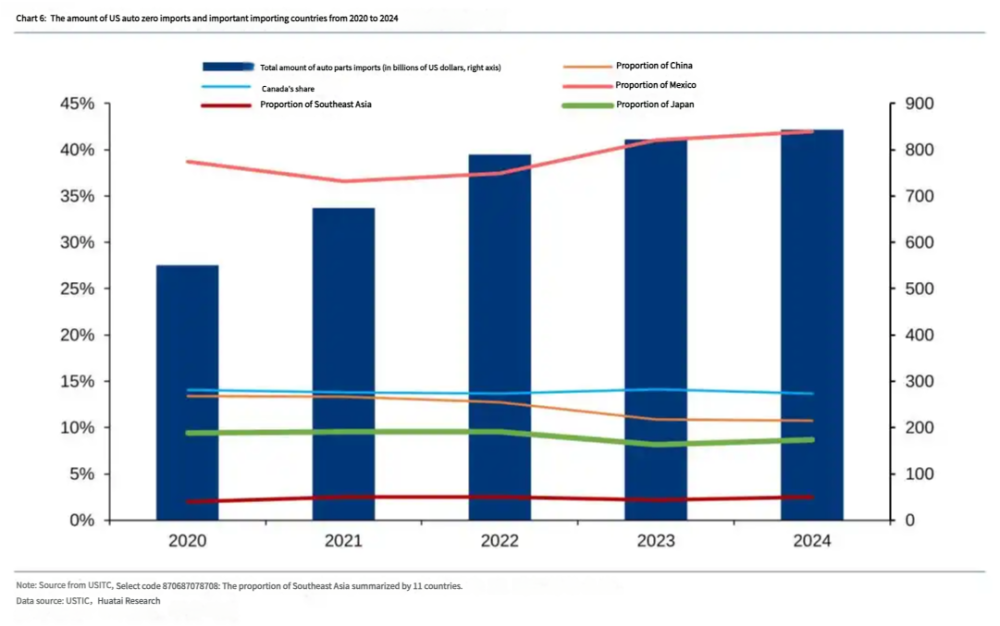

While Chinese finished vehicle exports to the U.S. remain limited (approximately 116,000 units in 2024, primarily from American brands like GM and Ford), the real pressure falls on auto parts suppliers. China's auto component exports to the U.S. have been declining, with $8.33 billion shipped between January-November 2024, accounting for 10.6% of total U.S. auto parts imports. Chinese suppliers must now increase North American localization and U.S. sourcing to mitigate tariff impacts.

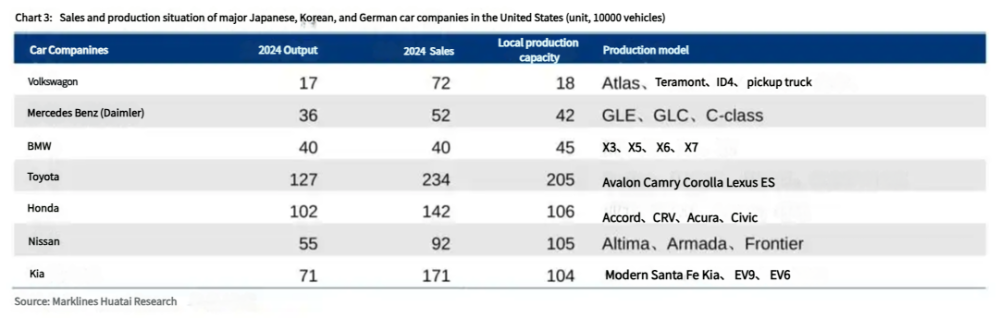

Major Challenges for Japanese, Korean and German Manufacturers

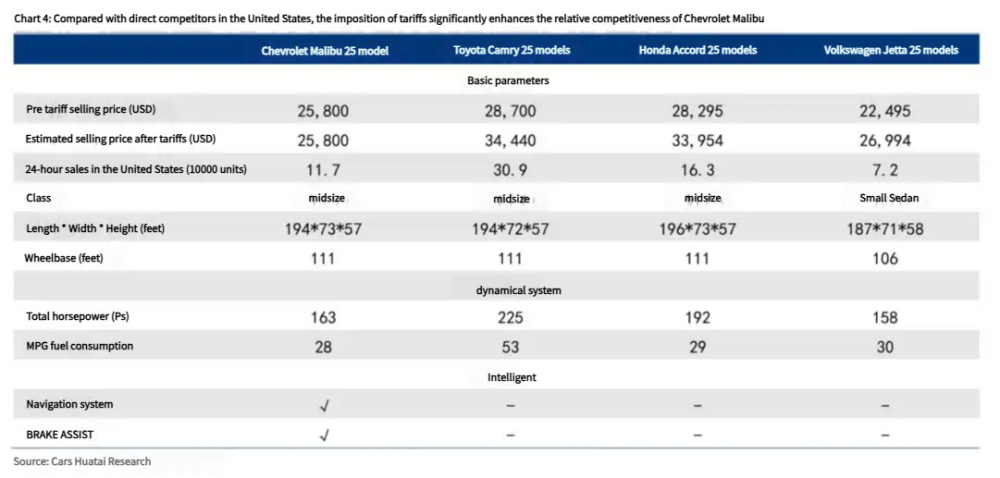

Japan (1.37 million units), Korea (1 million units) and Germany (550,000 units) face direct export reductions of 270,000, 200,000 and 160,000 vehicles respectively. These automakers now struggle to balance volume and profitability, forced to either raise prices or accelerate U.S. production - potentially leading to industrial hollowing-out in their home markets.

Mexico and Canada: The Tariff-Free Gateways

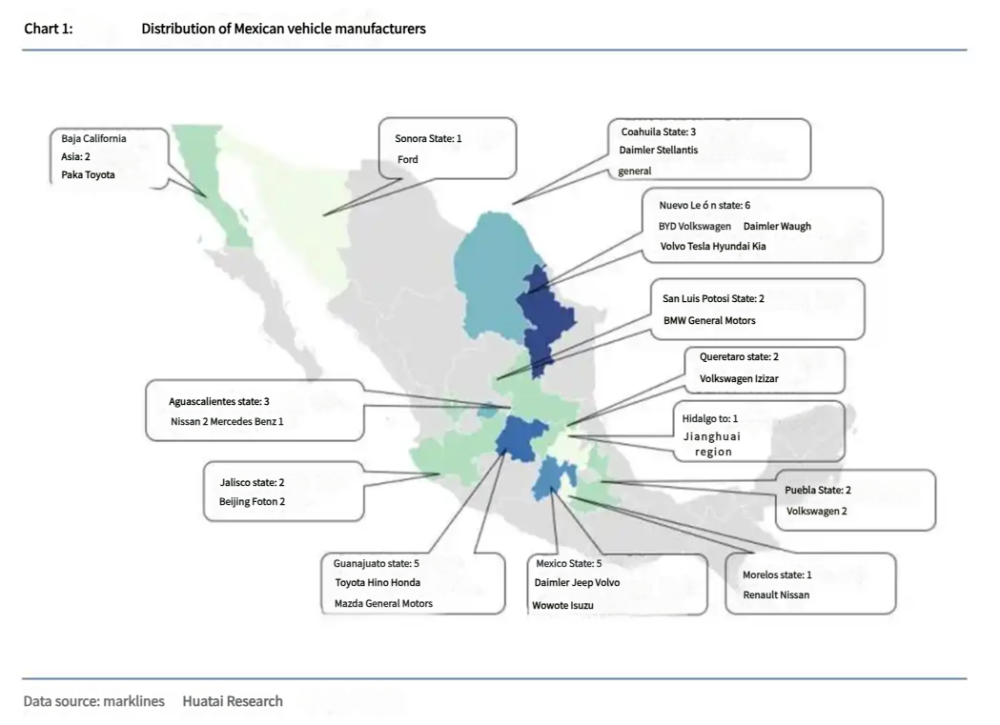

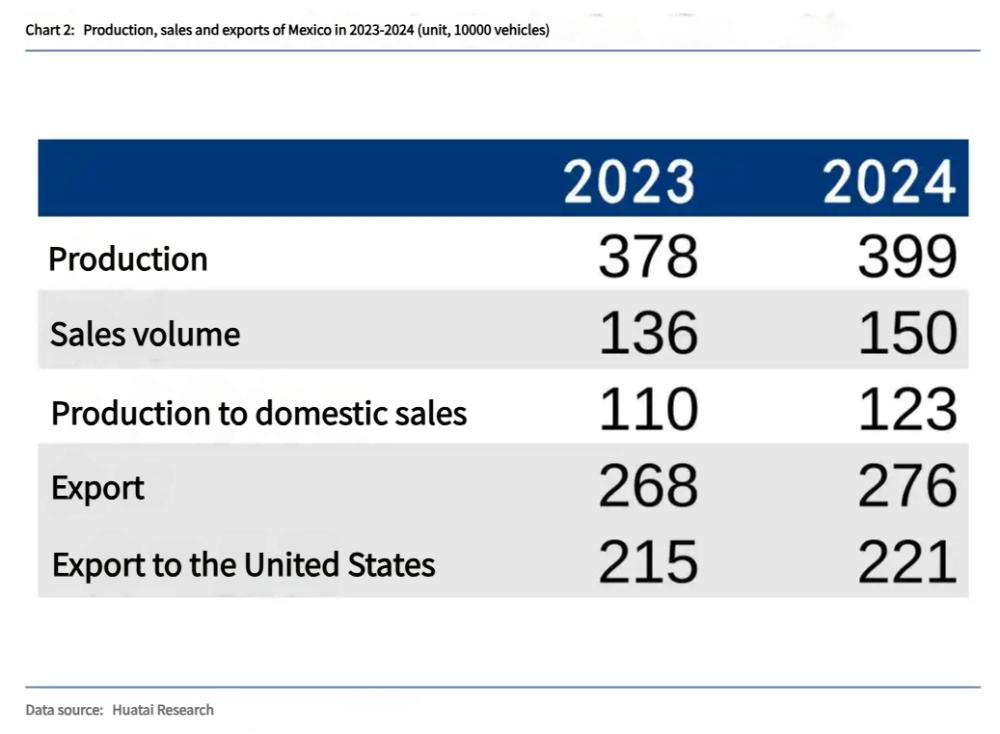

Vehicles meeting USMCA requirements (75%+ North American content with core components made regionally) enjoy zero tariffs. Mexico's strategic position grows stronger, having produced 3.99 million and exported 2.76 million passenger vehicles in 2024 (80% destined for U.S. markets). Its low production costs make it the preferred workaround for global automakers.

Tariff Policy Breakdown

- Finished Vehicles: 25% tariff effective April 3 (passenger car rates jump from 2.5% to 27.5%)

- Auto Parts: 25% tariff takes effect by May 3, with USMCA-compliant components temporarily exempt

- ATVs: Chinese manufacturers like CFMOTO can maintain competitiveness by shifting production to Mexico

Strategic Recommendations for Buyers

1. Consider USMCA-compliant vehicles from Mexican/Korean/Japanese plants for U.S. market access

2. Explore Chinese ATV alternatives with relocated production bases

3. Leverage TopUsedCars.com's end-to-end services for tariff-optimized sourcing and logistics

Market Risks to Monitor

- Intensifying global competition may squeeze automaker margins

- Trade policy changes could disrupt export plans

- Localization requirements may alter supply chain dynamics

Analysis by TopUsedCars.com journalist Xiao Mi