China Auto Market Report July 2025: Sales Trends & Top Models Analysis

China Auto Market Report: July 2025 Shows Stabilized Growth Amid Seasonal Slowdown

Market Overview

The Chinese passenger vehicle market demonstrated relative stability with slowing growth in July 2025, according to industry data. Nationwide retail sales of narrow-body passenger vehicles reached approximately 1.826-1.837 million units, representing a 6.3%-6.9% year-over-year increase but an 11.9%-12.4% month-over-month decline.

July traditionally marks the off-season for auto sales in China, compounded by annual maintenance shutdowns and summer holidays at several manufacturers. Notably, the market saw reduced promotional activities and price wars, with only 17 models announcing price cuts - significantly fewer than previous periods.

Top-Performing Models & Trends

| Rank | Model | July Sales (Units) | Starting Price (USD) | Key Attributes | Trend |

|---|---|---|---|---|---|

| 1 | Geely Xingyuan | 44,274 | $9,201 | Wide compact sedan | +3,000 units |

| 2 | BYD Qin PLUS | 31,237 | - | PHEV/EV | Declining |

| 3 | Tesla Model Y | 30,766 | - | Electric SUV | -14,000 units |

| 4 | Wuling Hongguang MINIEV | 27,337 | - | Micro EV | Stable |

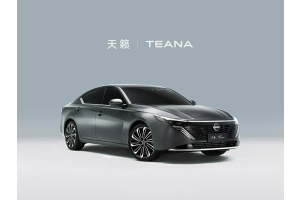

| 5 | Nissan Sylphy | 26,337 | <$9,790 | Gasoline sedan | - |

Key Market Developments

- New energy vehicles continue gaining market share while traditional gasoline models see demand shifting to lower-tier cities

- Promotional activities decreased with average discounts at 10.2% for NEVs and 23.4% for gasoline vehicles

- Government trade-in policies boosted micro EV sales (e.g., MINIEV) while entry-level gasoline sedans (Sylphy, Lavida) remain popular in smaller cities

- Premium models like the Aito M8 (21,564 units sold) demonstrate strong demand in the luxury segment

Notable Changes

Li Auto's L6 model dropped out of the top 20 with only 14,830 units sold, as competitors have replicated its signature home-style features at lower price points.

Xiaomi's SU7 maintained momentum with 24,410 units sold despite approaching production capacity limits.

Comparative Analysis of Leading Models

| Model | Sales | Price Range (USD) | Type | Competitive Edge |

|---|---|---|---|---|

| Geely Xingyuan | 44,274 | $9,201+ | Gasoline/Hybrid | Size, features at low price |

| BYD Qin PLUS | 31,237 | $13,986+ | PHEV/EV | Established NEV brand |

| Tesla Model Y | 30,766 | $34,965+ | Electric SUV | Autopilot technology |

| Wuling MINIEV | 27,337 | $4,196+ | Micro EV | Ultra-affordable urban mobility |

Market Outlook

Industry projections estimate 4.7% growth for 2025 overall, with new energy vehicles expected to grow 24.4% to approximately 16 million units annually.

As automakers slow new model launches and price competition eases, market conditions appear favorable for profitability recovery. The NEV adoption rate continues climbing, accelerated by smart features and premiumization trends.

For international buyers considering Chinese vehicles, TopUsedCars.com provides comprehensive export services including logistics and customs clearance.