BYD Overtakes Tesla in European EV Market: Key Insights and Data (July 2025)

BYD Overtakes Tesla in European EV Market: Key Insights and Data (July 2025)

Market Dominance: BYD Surpasses Tesla Across Europe

In a historic shift, BYD sold 11,123 EVs across 14 European countries in July 2025, dwarfing Tesla's 6,253 units. This marks a pivotal moment in the region’s automotive landscape, with BYD’s growth outpacing Tesla in major markets:

Sales Breakdown by Country (April 2025)

| Country | BYD Sales | Growth (YoY) | Tesla Sales | Tesla's Performance |

|---|---|---|---|---|

| Germany | 1,566 | +390% | 885 | -45.9% |

| UK | 2,511 | +654% | 512 | -62% |

| Spain | 1,545 | +644% | 571 | -36% |

| 14-Country Total | 11,123 | — | 6,253 | — |

Note: Tesla maintains strength in Nordic markets (e.g., Norway: 2,600 units), but BYD leads in Western/Southern Europe.

Why BYD is Winning Europe

1. Strategic Product Lineup

- Seagull (Haiou): 3,990mm length, L2 ADAS, and heat pump standard – ideal for narrow European streets.

- ATTO 3 (Yuan PLUS): Priced 18% below Renault Zoe with superior tech.

- Seal (Haibao): Euro NCAP 5-star, outperforms Porsche Taycan in torsional rigidity.

2. Technology & Safety Edge

BYD’s 1000V ultra-fast charging is already in mass production, while Tesla struggles with 4680 battery production. Seal’s ADAS outperforms BMW iX3 in Euro NCAP tests.

3. Localized Production

BYD’s European assembly plants reduce costs and improve service speed vs. Tesla’s import-heavy model.

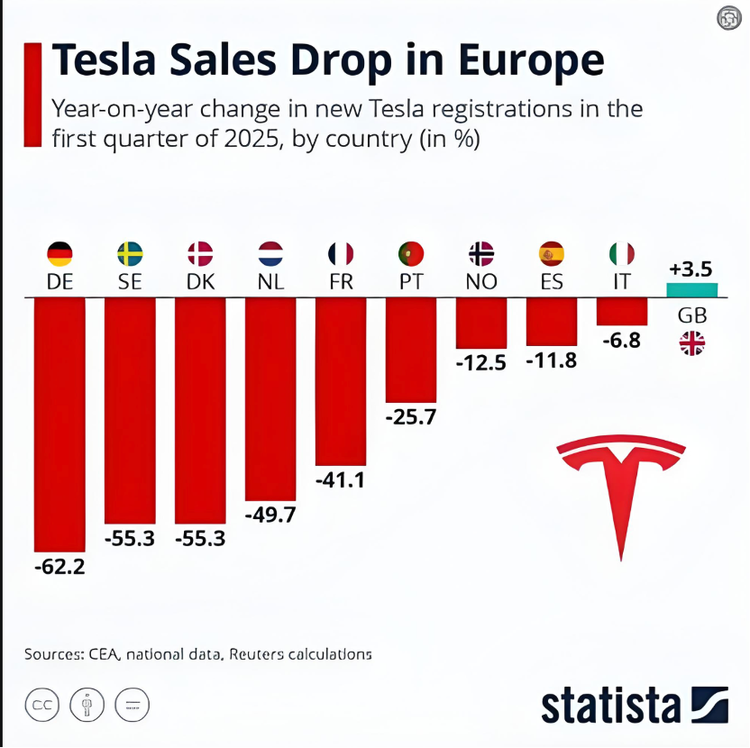

Tesla’s Challenges

- Declining Sales: UK (-62%), Germany (-45.9%), Spain (-36%)

- Product Stagnation: No Model 2 launch, Cybertruck recalls

- Tech Lag: BYD’s blade battery safety surpasses Tesla’s 4680

Model Comparison

| Model | Price (EUR) | Key Features |

|---|---|---|

| BYD Seagull | ~20,000 (est.) | Compact size, 2500mm wheelbase, L2 ADAS |

| BYD Seal | 44,900 | Faster charging than Model 3, higher safety |

| Tesla Model 3 | 40,970 | FSD subscription, brand legacy |

The Bottom Line

BYD’s multi-model strategy and localized approach have disrupted Tesla’s dominance. While Tesla leads in Scandinavia, BYD now controls Western Europe’s growth markets – a blueprint for global EV exporters.